Our method for fast cash recovery

-

Profit Recovery

-

FastPR Methodology

Discover the power and speed of our FastPR methodology

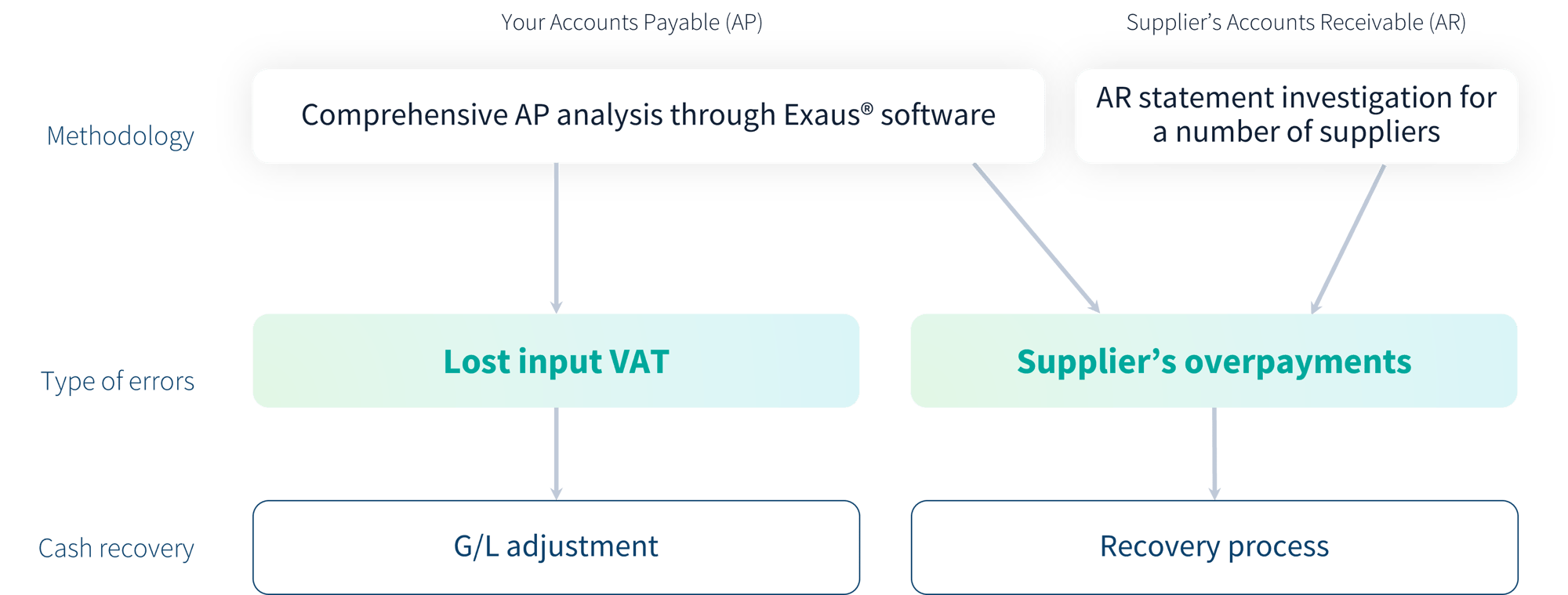

Our methodology

With our audits, large corporations and mid-sized companies benefit from our winning trio: expertise, technology, and proven methodology. Refined and continuously improved over more than 20 years of missions, this approach has given rise to the FastPR methodology—Fast Profit Recovery .

This is our promise: simple, fast, and thorough Profit Recovery audits. Our expertise spans several key areas:

- Identifying overlooked input VAT and supplier over-payments through the analysis of your accounting data,

- Detecting supplier over-payments via statement review, by analyzing accounting data for a list of your suppliers.

The adjacent flowchart illustrates how we maximize cash recovery by spotting accounting incidents within your accounts payable and highlighting discrepancies between your records and those of your suppliers—all with minimal involvement from your teams.

The pillars of our methodology

Our audit methodology is built on two core pillars: Exaus®, our data-mining and artificial intelligence software for processing and analyzing large volumes of data, and our teams of accounting, tax, and recovery experts.

Our consultants investigate potential errors to guarantee the lowest false-positive rate in the market. They oversee accounting analyses and review supporting documents to confirm anomalies flagged by our software. For supplier over-payments, our dedicated, autonomous recovery team handles the collection of identified amounts. For overlooked VAT, you simply report these amounts on your VAT return (CA3). This way, you recover cash effortlessly, without requiring internal team involvement.

A dedicated, secure platform

Our platform is user-friendly, customizable, and lets you communicate directly with our teams. You can create views, apply filters, add comments, and more. After the audit, you can review detailed documentation of anomalies. Preparing the documents collected by Runview takes no more than one day. Required files are easily uploaded to our platform, which is hosted on servers in France.

Technology combined with consultant expertise

The expertise and experience gained through numerous missions ensure the relevance of anomalies identified by our algorithms. Our consultants, specialists in accounting and tax, are experts in Profit Recovery audits. For supplier statement reviews, suppliers are selected based on statistical criteria and our client experience—our team then performs the third-party analysis.

Minimal resource consumption for your company

Runview requires little time or resources from your team, as our consultants carry out the mission autonomously. This type of audit can be conducted at any time of year without disrupting operations—and without upfront costs, since our compensation is success-based (success-fee).

The audited company remains in control throughout the mission

The client retains control at every stage of the audit. You validate the anomalies identified and the list of suppliers for statement review. At the same time, our secure platform lets you track progress in real time with full transparency, using predefined summary dashboards.

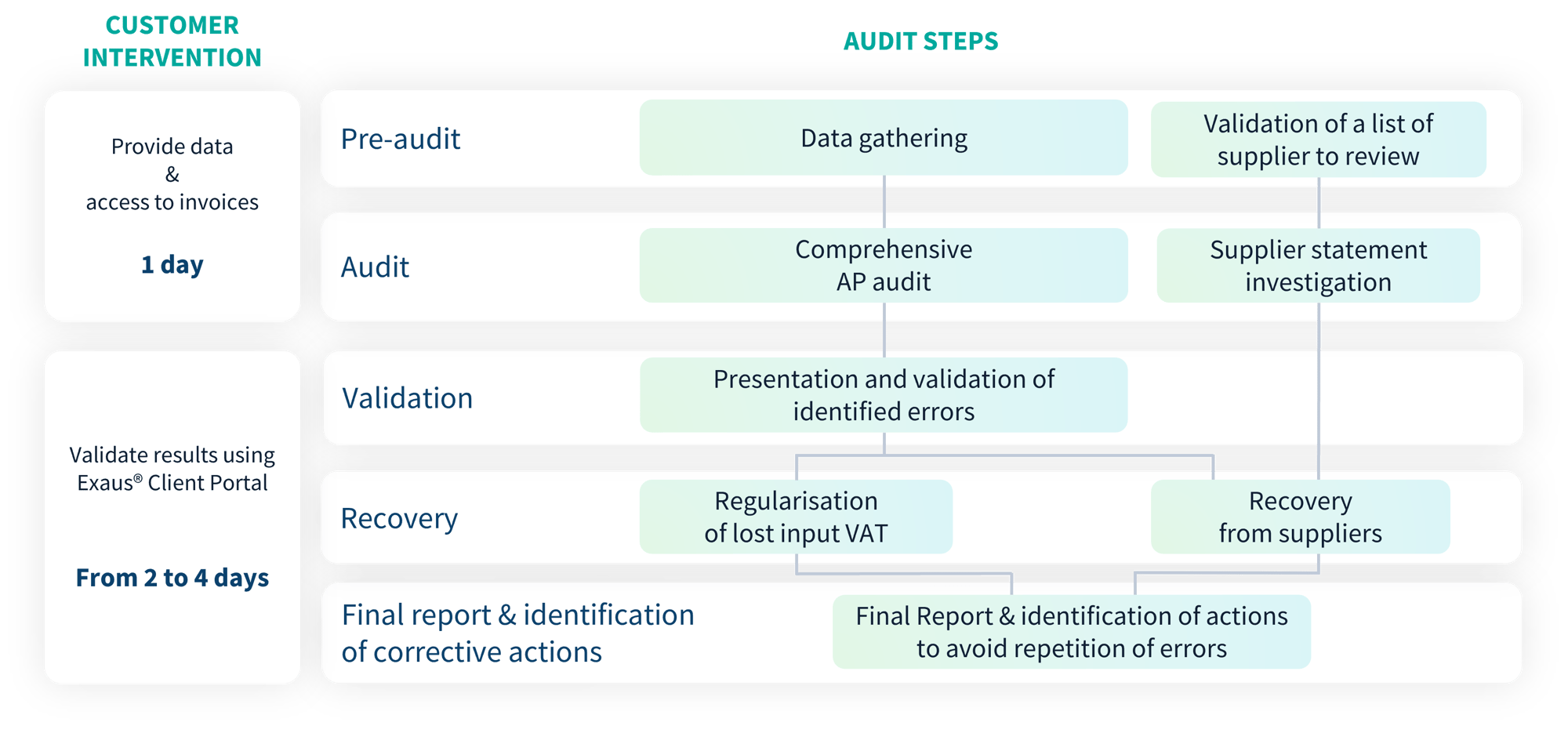

Audit steps

From launch to final reporting, our approach is designed to minimize demands on your team. Beyond providing access to accounting entries and supporting documents, your involvement is limited to sending accounting data and validating results or confirming reimbursements.

We collect your accounting files (FEC or other exports from any ERP) via our secure Exaus® Client Portal. We may also request access to your ERP and invoice archiving software. We provide a list of suppliers for statement review, which you can quickly approve via our platform.

Once the audit is complete, we present the results for your validation. This step can be split into phases to suit your availability. Next, we handle the recovery of validated amounts. You can immediately regularize overlooked VAT on your monthly VAT return (CA3). Our specialized recovery team manages the reimbursement process in full.

Finally, we deliver our comprehensive final audit report at the completion meeting. This report includes a summary of audit results, the origin of errors so you can implement corrective actions, benchmarks, and a sector comparison. In case of a tax audit, you can access supporting documents on our secure Exaus® Client Portal and export results at the end of the mission.

Recovery, handled by Runview

We proceed with supplier over-payment recovery as soon as amounts are validated. Recovery is conducted amicably and with careful attention to your supplier relationships—a point of major importance for our experts.

Recovery of over-payments is handled transparently with suppliers:

- If your account is up to date, we ask the supplier to refund the over-payment by bank transfer directly to your account.

- If your account has outstanding invoices, we inform the supplier that the over-payment will be settled by offset during your next payment.

- If a supplier prefers to refund by check, we ask them to issue it directly to your company.

They have tested our FastPR Methodology

Final audit report and recommendations

A comprehensive report

The audit report and educational recommendations we provide at the end follow a “bottom-up” approach. We start with the data (errors actually identified or cash actually recovered) and organize it into coherent groups (fiscal year, journal, nature, company, etc.).

Recommendations for lasting improvement

This approach highlights confirmed weaknesses and enables quick, targeted corrective actions to prevent recurrence of most errors: practical training for the accounting team based on real cases of overlooked VAT, assigning complex accounting tasks to trained staff, cleaning up your supplier database, reinforcing the importance of following Procure-to-Pay (PtoP) processes, etc.

They have benefited from our report

A win-win audit

Our compensation model ensures a positive return on investment. We operate on a success-fee basis—a percentage of amounts actually recovered—allowing you to launch an audit with no upfront costs.

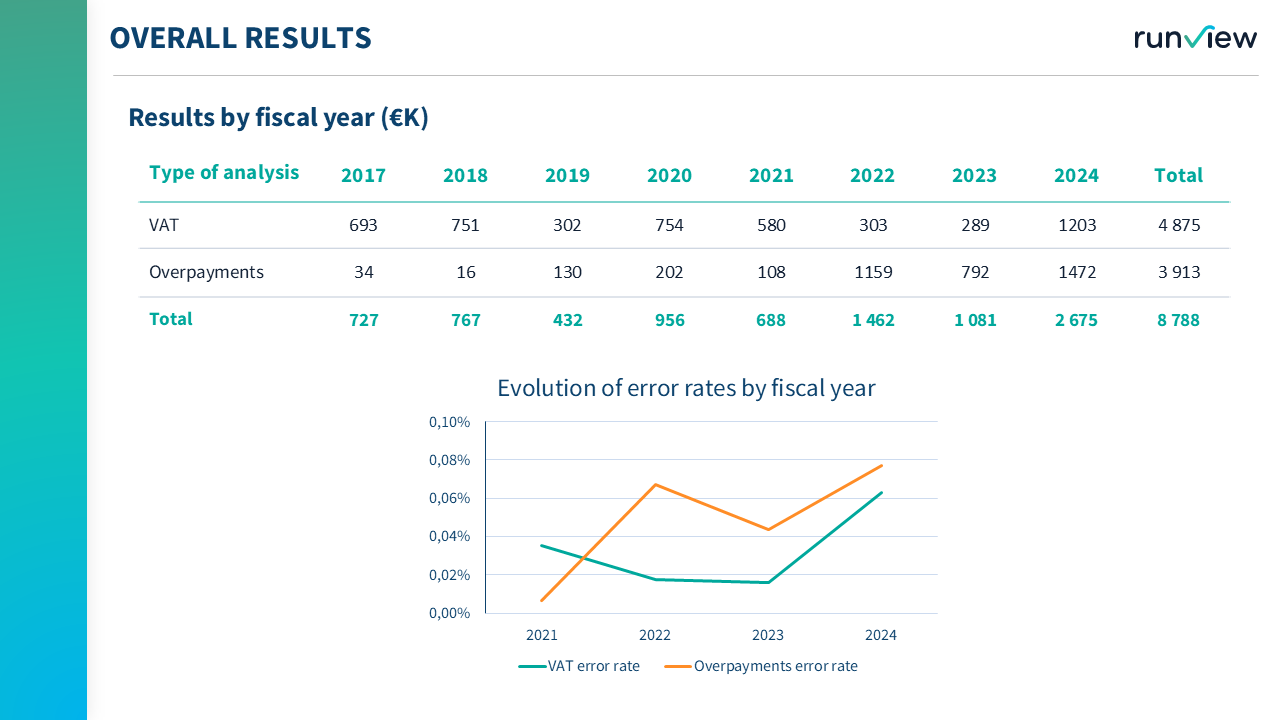

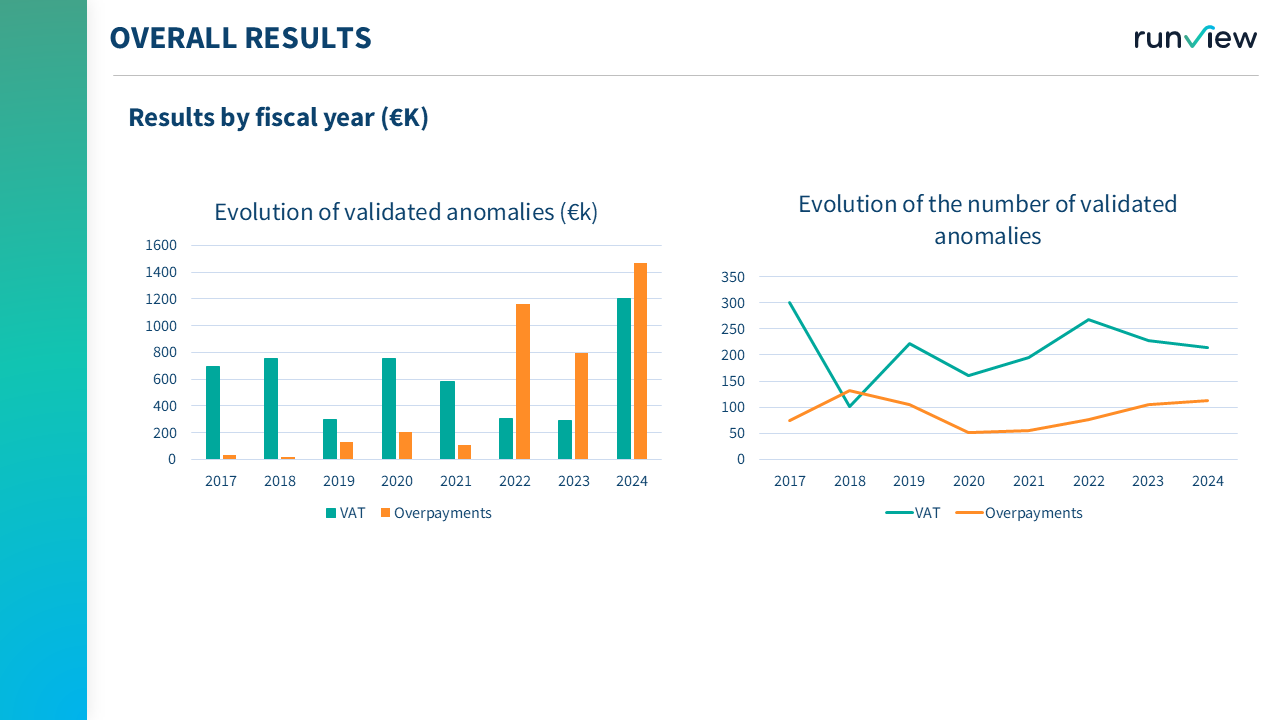

Most amounts are ready to be recovered within 12 to 16 weeks. In 2019, the average recovery per mission was nearly €400,000 in supplier over-payments for our clients, with some large corporations recovering up to €700,000. If few anomalies are detected, you have the assurance of an independent expert that your accounting processes are effective.